Content

This is not an exhaustive list of questions or even topics. You still need to review all material and it would be a good idea to create your own questions to try to answer.

This is not an exhaustive list of questions or even topics. You still need to review all material and it would be a good idea to create your own questions to try to answer.

Forward-looking theories suggest that individuals consider their future income when making consumption decisions. In the short run, an increase in current income may not lead to a proportional increase in consumption if individuals expect the income change to be temporary. This results in a less responsive consumption function to short-run income changes.

Forward-looking consumption theories imply that the multiplier for government stimulus may be smaller if it is a one time payment (which is typical). The marginal propensity to consume out of the stimulus funds will be low, and thus

The “market for lemons” problem refers to the asymmetric information in a market where low-quality goods (lemons) drive out high-quality ones. In credit markets, this relates to credit rationing, where lenders may restrict the amount of lending, deny loans, or require collateral due to the inability to distinguish between high and low-risk borrowers. For example, if a bank is uncertain about the creditworthiness of borrowers, it may restrict lending, leading to credit rationing.

Imperfect information in credit markets increases the risk for lenders (as suggested in the market for lemons problem). To mitigate this risk, lenders may demand equity or collateral from borrowers as a form of security against potential defaults. As our reading suggests, this can mean that banks lend most easily to those who don’t need money!

Credit rationing can limit access to funds for individuals, affecting their ability to smooth consumption over time. In other words, they will not be able to finance a constant level of consumption when their income is temporarily low. As a result, current (as opposed to future or lifetime) income may have a larger effect.

Businesses can finance investment projects through various sources, including internal funds (retained earnings), debt financing (bonds or loans), and equity financing (issuing new shares). Often we see firms prefer to use retained earnings over debt or equity financing.

The present value of a $10,000 payment in 10 years at a 5% interest rate is calculated using the formula: (

Hurdle rates represent the minimum acceptable rate of return for an investment project. They impact investment decisions by serving as a benchmark; projects with returns below the hurdle rate may be rejected. As we said in class and is reiterated in the article Do Interest Rates Really Drive the Economy? by J.W. Mason, there doesn’t seem to be evidence that hurdle rates change much with current interest rates. In other words, reasonable changes in interest rates don’t seem to affect business investment decisions much.

(This is covered well in the Investment and Finance reading on p. 298-299). The cost of borrowing may increase as a firm borrows more for investment projects because a larger portion of the firm’s cash flow is allocated to servicing these debts. This increases the risk to lenders that a firm will not be able to make a future debt payment, so they will charge a higher rate. This risk increases because if there some minor hiccup in cash flow, the less margin of safety a firm has in terms of meeting its debt commitments.

In addition, lenders may also face a “moral hazard” problem wherein firms who borrow may be incentivized to take on excessive risk or engage in reckless behavior because they do not face the full consequences of their actions (the lender does face consequences if the firm goes bankrupt).

In class we said this could come from three areas: this could be because cash flow is a source of funds for investment (retained earnings), an indicator of credit quality (lenders don’t like it when firms have a large share of cash flow commited to debt service), or serves as a predictor of future sales. There is evidence all three of these things matter.

Even if a firm uses retained earnings to finance investments, the opportunity cost of not investing those earnings elsewhere represents an implicit cost, making interest rates relevant.

The present value

Firms may prefer using internal funds (retained earnings) over issuing equity to avoid diluting ownership and maintaining control over the company.

Firms may prefer using debt over equity when financing investment projects because interest payments on debt are tax-deductible, making debt financing more cost-effective.

Since debt then is preferred to equity finance, firms which attempt to sell new equity send a signal that they may not be able to bear greater debt and so represent riskier investments. Financial markets may view issuing new equity as a sign of trouble.

Banks create money when they make loans by expanding their balance sheets. Contrary to a common misconception, banks do not lend out money deposited by others; they create new money through the lending process. The process of of making a loan involves the creation of both a bank asset (the loan) and a bank liability (the deposit). Bank liabilities (deposits) are considered money in the modern economy. Indeed they are the dominant form of money most of us use. This does not require a prior deposit or reserves at the central bank. What is required however is for a bank to have enough reserves to meet their net liquidity requirements (money they owe to other banks at the end of the day because of deposits that have been moved). This is largely a question of managing their assets so that the share of liquid assets on their balance sheet is enough to cover these requirements. What is important to recognize is that banks make loans first, not knowing what their liquidity requirements will be, and later manage their assets to find the reserves they need for interbank transfers.

| Bank | Borrower | ||

|---|---|---|---|

| Assets | Liabilities | Assets | Liabilities |

| + Loan | + New Deposit | + New Deposit | + Loan |

What is important to recognize is that if the seller of the home is also a customer of the bank, all that has to happen next is that the deposit gets transferred into their name (and the house gets transferred to the borrower). Bank lending creates an asset and liability and the liability (new deposit) is money. No prior deposits are required, money has been created just by the act of lending.

After the seller of a home requests to transfer their deposit from one bank to another, the two banks must settle with each other. That is, a liability (the deposit) will be transferred from the liabilities of one bank, and placed on the liabilities of the second. This has to be balanced in the process of settlement. At the end of the day, the banks tally up the liabilities moved between their balance sheets (some will have gone in one direction, others in the other direction). They net these out to figure out who owes. This means that the final amount that needs to be settled with an asset is far less than the total transactions between the bank customers. The settlement asset used are reserves held at the Federal Reserve. One bank will tell the Federal Reserve to transfer the net amount owed to the other bank from their reserve account.

For each of the following discuss what functions of money they serve and for whom:

a. Reserves are money for banks, and are used for the purpose of settlement. Reserves don’t really function as money in other respects and cannot be held by anyone but banks.

b. Treasuries can be used as a store of value, particularly for those institutions who have large values they need to store safely and would not want to hold these values in a bank deposit (the values exceed the limits for deposit insurance). Treasuries can also sometimes be used as a medium of exchange in some financial transactions like mergers or acquisitions.

c. Fiat currency is held by individuals and some businesses. It functions as a store of value, medium of exchange, settlement asset, but serves these functions more or less well depending on context (some places won’t accept cash).

d. Bank deposits are pretty similar to fiat currency in their use by individuals. They may serve these functions more or less well depending on the context (some places won’t accept debit cards or personal checks).

A liquidity crisis refers to demands for banks to provide liquidity to their lenders. In a classic bank run, this would be depositors requesting for their deposits to be converted to cash. In a more modern bank run, this could be short term lenders to the bank demanding their loans be paid back immediately (or refusing to renew short term loans). If banks don’t have enough liquidity on their asset side to meet these demands, they must convert (sell) illiquid assets. The problem arises because by definition, illiquid assets cannot be sold quickly at their maximum value. When a bank is forced to sell these quickly to meet short term demands of depositors or lenders, they will likely have to sell them at “fire sale prices” (i.e. below their true value).

The leverage ratio represents the proportion of a bank’s capital to its total assets. A higher leverage ratio increases a bank’s vulnerability to insolvency and impacts profitability. While a higher ratio may enhance profitability, it also amplifies the risk of financial crises. The bank has very little in the way of a “capital cushion” if their assets fall in value due to financial market panic.

Bank insolvency refers to a situation in which bank liabilities exceed the value of their assets. Bank liquidity problems are when a bank has insufficient liquidity on its asset side to meet its liability demands. A bank could be solvent but illiquid (and vice versa). However, liquidity problems may force banks to sell their illiquid assets at a low value (described in the previous question) and thus generate an insolvency problem.

Liquidity refers to the ease with which an asset or liability can be bought or sold in the market without significantly affecting its price. High liquidity implies easy and quick conversion, while low liquidity may result in price fluctuations and difficulty in selling. Not that there is actually a lot more to the concept of liquidity (it is a really deep notion!) but for our purposes this the working definition we will use.

Prior to 2008, the Federal Reserve used traditional open market operations. This means that they would buy and sell Treasuries to create or destroy reserves in order to alter the interest rate on overnight reserve loans (the so-called “fed funds rate”). After 2008 the banking system was so flooded with reserves (the Fed created a ton in the process of buying toxic assets off of bank balance sheets and other operations) that it no longer made sense to use open market operations as a policy tool. Now, the federal reserve directly adjusts two key interest rates: the interest on reserves and the overnight reverse repurchase rate. Interest on reserves is a floor on interest rates set by the federal reserve for banks who hold reserves at the Federal Reserve. The overnight repurchase rate functions similarly for non-banks. Financial institutions will never lend to the public (households and firms) at a rate lower than the floor set by these two rates because the Fed is the ultimate safe borrower - these loans to the Fed are risk-free.

The federal reserve increases the interest rate at which it lends to financial institutions. These institutions will raise the interest rate at which they lend to the public (households and firms) because they add a risk premium to the rates the Fed sets. Faced with higher interest rates some households and firms in the economy will lower their spending (particularly on consumer durables and residential investment). In addition, the higher interest rates will make bonds more attractive to foreign investors. As these foreign investors demand more dollars to buy bonds, the value of the dollar exchange rate will appreciate. This in turn will lower our exports (our goods will look more expensive to others) and increase our imports (foreign goods will look cheaper to US buyers). So the effect of higher rates will be to lower consumption, investment and net exports. This lower spending will cause labor markets to weaken (unemployment will increase) and workers wages will begin to fall. Facing lower wage costs, and lower demand for their goods, the hope is that firms will lower prices.

Board of Governors:

Federal Reserve Banks:

Federal Open Market Committee (FOMC):

The Federal Reserve operates under a dual mandate, which outlines its objectives and responsibilities in pursuing stable prices and maximum sustainable employment. This dual mandate was codified by the Full Employment and Balanced Growth Act of 1978, commonly known as the Humphrey-Hawkins Act (if you are interested in the history of this, and the involvement of Coretta Scott-King check out this podcast. The dual mandate reflects the recognition that both price stability and full employment are critical to the overall health and well-being of the U.S. economy. Here’s an overview of the Federal Reserve’s dual mandate:

Objective: The Federal Reserve aims to maintain stable prices to foster long-term economic growth and provide a foundation for sound economic decision-making.

Measure: The Fed uses the Personal Consumption Expenditures (PCE) price index as its primary measure of inflation. The target rate for inflation is not fixed but is generally around 2%, as measured by the annual change in the PCE price index.

Objective: The Federal Reserve seeks to promote maximum sustainable employment, which is the highest level of employment that the economy can sustain over the long term without causing inflationary pressures.

Measure: The Fed considers a range of labor market indicators, including the unemployment rate, labor force participation rate, and other measures of labor market conditions.

Interest rate premia represent the additional compensation lenders require for taking on risk when setting interest rates on loans. The risk premia includes compensation for several different kinds of risk:

Default risk (the risk that your loan won’t be repaid)

Liquidity risk (the risk that you may need to sell the loan quickly and the costs associated with this)

Term risk (the risk that future interest rates may be higher and you’ve locked up your money in a low interest rate loan).

Risk aversion (the tolerance of lenders for risk)

Increases in any of these risks could lead to a higher risk premia.

The real interest rate that borrowers use to make decisions is based on:

the nominal risk free rate (

inflation expectations (

the risk premia (

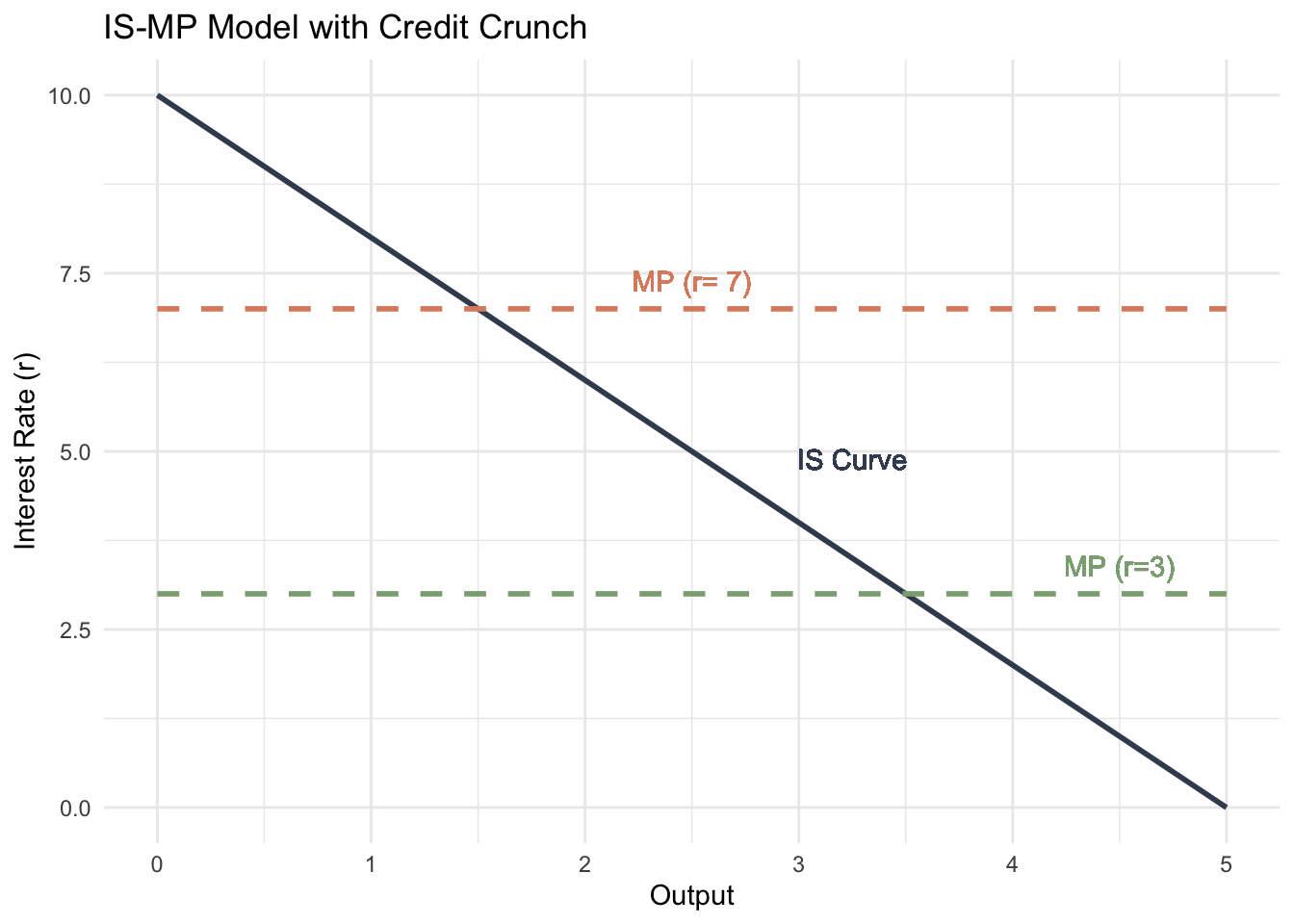

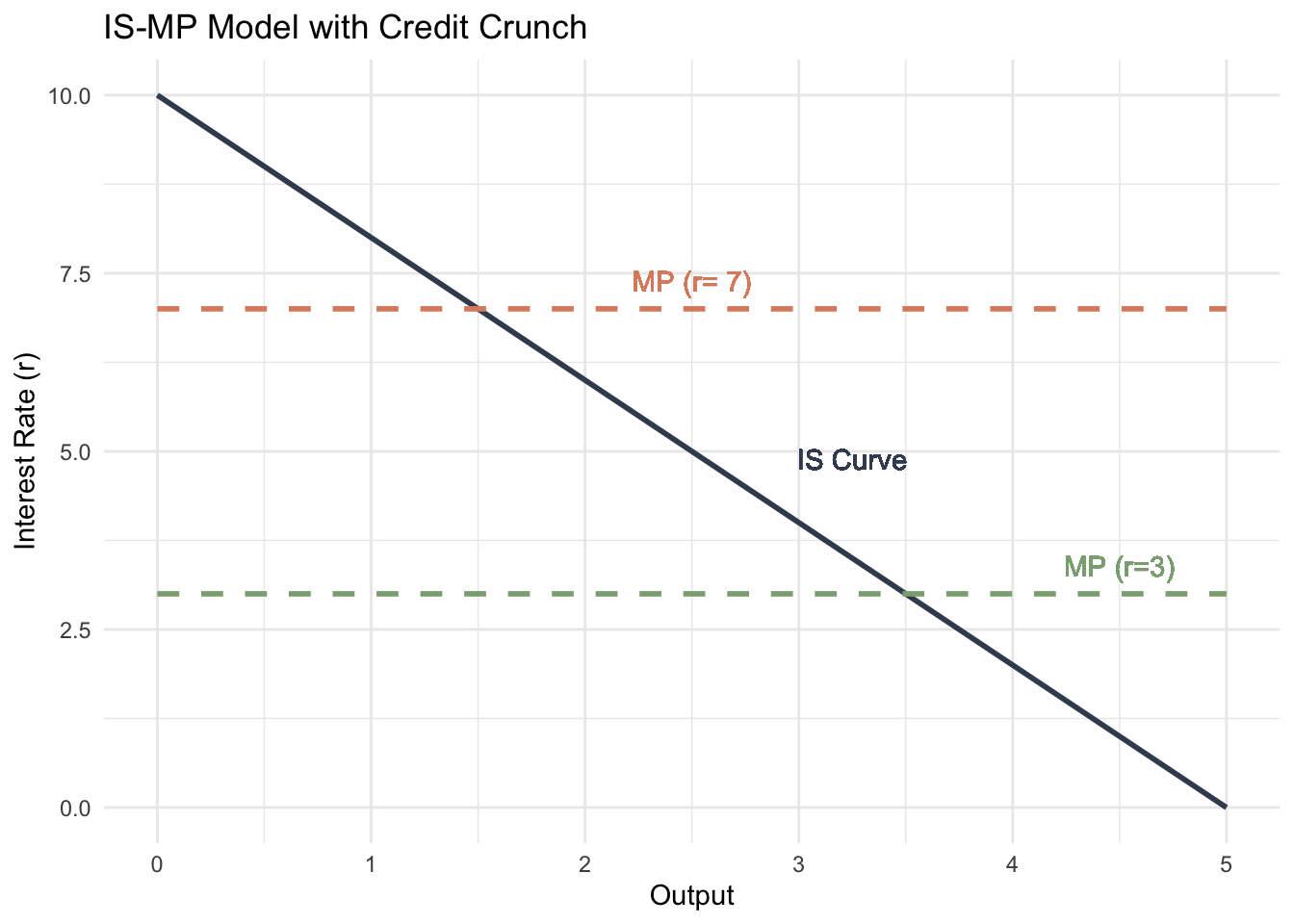

The IS curve will shift if an autonomous portion of consumption changes excluding the interest rates. Changes in the interest rate will be movements along the curve, while autonomous portions of spending (like

The slope of the IS curve is determined by both the multiplier and the sensitivity of spending to interest rate changes. If spending in the economy becomes more interest sensitive or if the multiplier becomes larger, the slope of the IS curve will become flatter (changes in interest rates will produce large changes in equilibrium output).

Monetary policy would be more effective if the IS curve were flatter, indicating a higher responsiveness of output to changes in interest rates. In a flatter IS curve, smaller changes in interest rates lead to larger changes in output, making monetary policy more impactful.

Discuss (in detail!) the effect of a decline in interest rates on:

As we have said, consumption of durables tends to be interest sensitive as those goods are expensive relative to income, easily postponed, and likely to be purchased on credit. These goods can also be used as collateral for the loans that finance them. In general though, because of credit rationing, consumption is still predominantly financed by current income and not credit.

Investment spending in general seems to be somewhat insensitive to interest rates (firms prefer using retained earnings, and hurdle rates for businesses are high and generally don’t move with interest rates). However, spending on residential investment does seem to be influenced by the level of interest rates.

Net exports are affected by interest rates as interest rates may cause changes in the exchange rate of the dollar. Higher interest rates will be associated with a strong dollar (appreciation) which will cause our goods to appear cheaper to foreign buyers and will cause foreign goods to appear more expensive to us. Thus high interest rates might be associated with lower net exports.

In the above graph, a credit crunch is represented as an increase in the risk premia (

Any change in: