Assignment 3

A Microsoft word version of the assignment can be found here

Answers to this assignment can be found here

CPI Practice

The Consumer Price Index represents the average price of goods that households consume. Many thousands of goods are included in such an index. Here consumers are represented as buying only food (pizza) and gas as their basket of goods. Here is a representation of the kind of data the Bureau of Economic Analysis collects to construct a consumer price index. In the base year, 2012, both the prices of goods purchased and the quantity of goods purchased are collected. In subsequent years, only prices are collected. Each year, the agency collects the price of that good and constructs an index of prices that represents two exactly equivalent concepts: How much more money does it take to buy the same basket of goods in the current year than in the base year? How much has the purchasing power of money declined, measured in baskets of goods, in the current year, from the base year?

The data: In an average week in 2012, the Bureau of Economic Analysis surveys many consumers and determines that the average consumer purchases 2 pizzas and 6 gallons of gas in a week. The prices per pizza and per gallon in subsequent years are shown below.

| Year | Price of Pizzas | Price of Gas |

| 2012 | $10 | $3 |

| 2013 | $11 | $3.30 |

| 2014 | $11.55 | $3.47 |

| 2015 | $11.55 | $3.50 |

| 2016 | $11.55 | $2.50 |

| 2017 | $11.55 | $3.47 |

What is the cost of the consumer price basket in 2012?

What is the cost of the consumer price basket in 2013 and in subsequent years?

Represent the annual cost of the consumer price basket as an index number. Set the value of the index number equal to 100 in 2012.

Calculate the annual rate of inflation using the percent change in the value of the index number between each year from 2013 on.

Is there a year in which inflation is negative? Why does this happen?

What is the source of inflation in the year 2015? How is that different from inflation in 2013 and 2014?

How many baskets of goods can I buy with $100 in 2012? How many baskets can I buy with that money in 2017? What is the percentage decline in the purchasing power of my money? How does that decline relate to the change in the value of the price index between 2012 and 2017?

From 2013 to 2015, the price of a pizza remains the same. The price of gas rises. How might consumers respond to such a change? In 2016, the price of gas falls. What are the implications of such changes in relative prices for the construction of the Consumer Price Index?

Okun’s Law

Okun’s law states that when output growth is higher than usual, the unemployment rate tends to fall.

Explain why usual output growth is positive.

In which year—a year in which output growth is 2% or a year in which it is –2%—will the unemployment rate rise more?

Phillips Curve

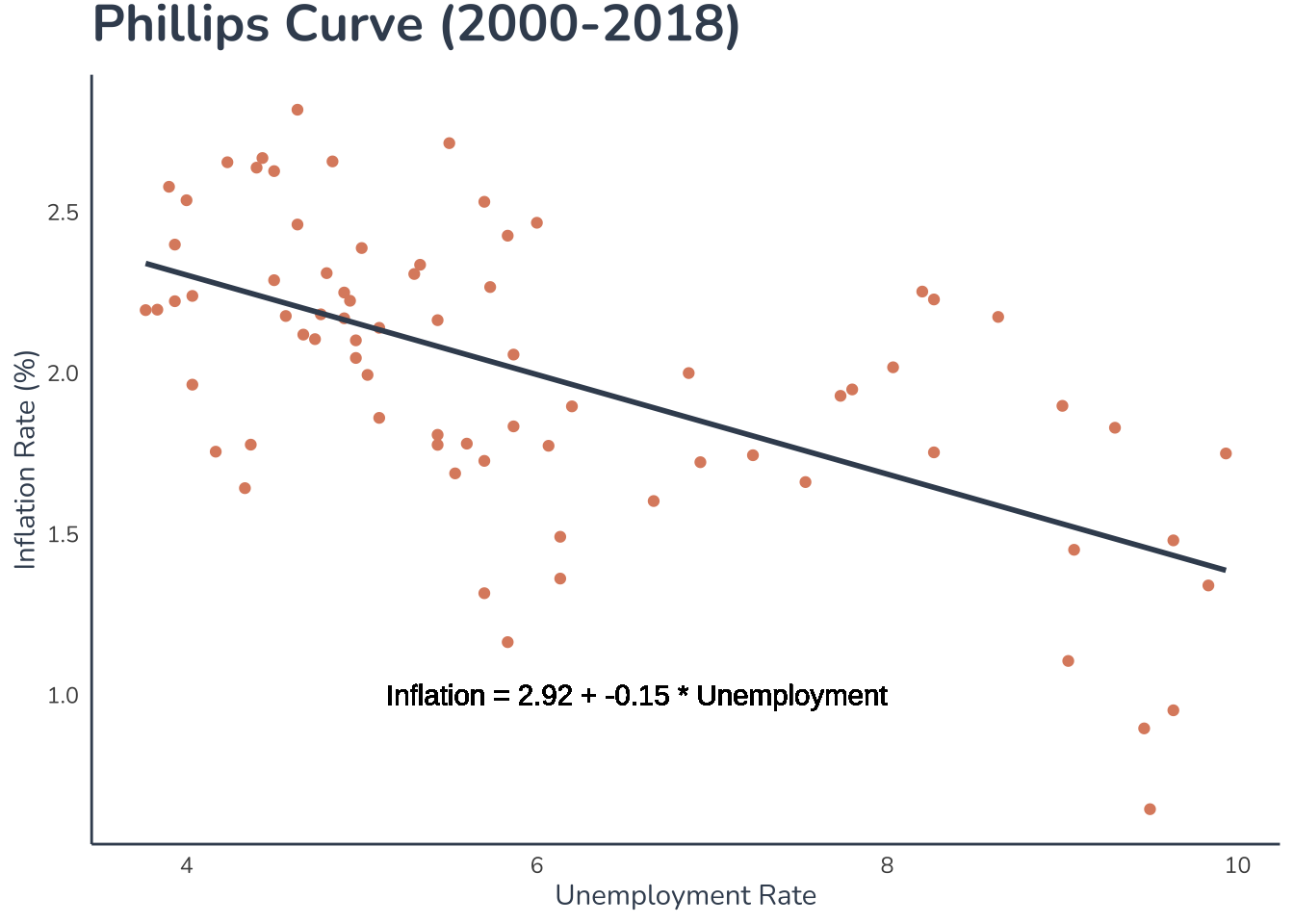

The Phillips curve is a relation between the inflation rate and the unemployment rate

Using the Phillips curve estimated above, is the unemployment rate zero when the rate of inflation is 2%?

The Phillips curve is often portrayed as a line with a negative slope. In the figure above, the slope is about -0.15. In your opinion, will the economy be “better” if the line has a large slope, say –0.5, or a smaller slope, say -0.1?

FRED

In the FRED database, the series that measures real GDP is GDPC1, real GDP in each quarter of the year expressed at a seasonally adjusted annual rate (denoted SAAR). The monthly series for the unemployment rate is UNRATE.

Use FRED to produce a graph of quarterly real GDP growth (percent change) from 1999 to 2010 and paste it in your homework.

Look at the data on quarterly real GDP growth from 1999 through 2001 and then from 2007 through 2009. Which recession has larger negative values for GDP growth, the recession centered on 2000 or the recession centered on 2008?

Produce a graph of the monthly unemployment rate (UNRATE) from 1999 to 2010 and paste it in your homework.

Is the unemployment rate higher in the 2001 recession or the 2009 recession?

The National Bureau of Economic Research (NBER),which dates recessions, identified a recession beginning in March 2001 and ending in November 2001. The equivalent dates for the next, longer recession were December 2007 ending June 2009. In other words, according to the NBER, the economy began a recovery in November 2001 and in June 2009. Given your answers to the previous questions, do you think the labor market recovered as quickly as GDP? Explain.