Macroeconomic Theory

Employment

Attendance

Agenda

1

Labor Market Debates

2

Finishing GDP

3

Labor Market Indicators

4

Review and to Do

Labor Market Debates

Review of Apricitas article

In class we discussed the Aprictas article and the implication that the labor market recovery is a big policy success as compared to the slow recovery from 2007

We also discussed the debate over whether the inflation we are experiencing is a tradeoff for employment recovery

Finishing GDP

Nominal vs. real

Nominal GDP Sum of the quantity of final goods produced times their current prices

Real GDP Sum of the quantities of final goods times constant (not current) prices

| Year | Quantity of cars | Price of cars | Nominal GDP | Real GDP (in 2012 dollars) |

|---|---|---|---|---|

| 2011 | 10 | $20,000 | $200,000 | $240,000 |

| 2012 | 12 | $24,000 | $288,000 | $288,000 |

| 2013 | 13 | $26,000 | $338,000 | $312,000 |

Real GDP in 2011 (in 2012 dollars) = 10 cars x $24,000 per car = $240,000

Real GDP in 2012 (in 2012 dollars) = 12 cars x $24,000 per car = $288,000

Real GDP in 2013 (in 2012 dollars) = 13 cars x $24,000 per car = $312,000

Price Index

For more than one good, relative prices of the goods are natural weights for constructed the weighted average of the output of all final goods.

Real GDP in chained (2012) dollars reflects relative prices that change over time.

The year used to construct prices is called the base year.

Practice

| 2012 Quantity | 2012 Price | 2013 Quantity | 2013 Price | |

|---|---|---|---|---|

| Coffee | 40 | $5 | 50 | $7 |

| Shoes | 400 | $100 | 450 | $100 |

| Surgery | 100 | $1000 | 80 | $1500 |

Calculate nominal GDP and real GDP in 2013 using 2012 as a base year.

Practice

| 2012 Quantity | 2012 Price | 2013 Quantity | 2013 Price | |

|---|---|---|---|---|

| Coffee | 40 | $5 | 50 | $7 |

| Shoes | 400 | $100 | 450 | $100 |

| Surgery | 100 | $1000 | 80 | $1500 |

Real 2013 GDP: $125250 and Nominal 2013 GDP: $165,350

Practice

| 2012 Quantity | 2012 Price | 2013 Quantity | 2013 Price | |

|---|---|---|---|---|

| Coffee | 40 | $5 | 50 | $7 |

| Shoes | 400 | $100 | 450 | $100 |

| Surgery | 100 | $1000 | 80 | $1500 |

Real 2013 GDP: $125250 and Nominal 2013 GDP: $165,350

Calculating GDP deflator (price index): $165,350$125250=1.32

In base year GDP deflator = 1, so 1.32 indicates prices have risen 32%

GDP symbols

Yt will denote real GDP in year t

$Yt will denote nominal GDP in year t

GDP critique and growth

Some exceptions

There are exceptions to the rules of GDP – big ones! - homeowners imputed rent - spending on behalf of consumers - financial services

This reminds us: GDP is a mix of money flows and some guesses at “welfare”

GDP and Life Expectancy

Growth rates

Remember that growth rates are always calculated as:

new−oldold

Labor Market Measurement

CPS Survey

Caution

Unemployment is not the same as unemployment insurance applicants!

Household measure:

- 60,000 eligible households (110,000 individuals)

- Monthly

- one-fourth of the households in the sample are changed every month

- live interviews conducted either in person or over the phone

Definitions

People with jobs are employed.

People who are jobless, looking for a job, and available for work are unemployed.

The labor force is made up of the employed and the unemployed.

People who are neither employed nor unemployed are not in the labor force.

Alternative measures of labor underutilizaiton

U-1: percentage of labor force with 15 weeks or more of unemployment.

U-2: job losers and people who completed temporary jobs.

U-3: The official unemployment rate

U-4: Includes discouraged workers who have given up on job searching.

U-5: Adds marginally attached workers who want a job but haven’t actively looked recently.

U-6: The broadest measure, incorporating all the above plus those working part-time for economic reasons.

Establishment survey

part of a regular electronic survey (Current Employment Statistics)

contacts about 160,000 businesses and government agencies, which pass on information about 440,000 worksites

establishment survey typically considered more reliable but lacks demographic and other info

Employment indicators

Prime age epop (CPS)

- male and female

Unemployment rate (CPS)

- demographic gaps

Prime age labor force participation (CPS)

Full time prime age employment (CPS)

Nonfarm payroll (CES)

Initial jobless claims (ETA)

Wage indicators

Employment Cost index

Average hourly earnings

Core non-housing services workers index

JOLTS

Quit rate

Layoff rate

Hiring rate

Job openings rate

Beveridge Curve

Illustrates the dynamic relationship between job vacancies and the unemployment rate.

Shows how economic conditions impact the match between job seekers and job openings.

Shifts in the Beveridge Curve can signal changes in the labor market’s health.

Movements along the curve reflect cyclical changes in unemployment and job vacancies.

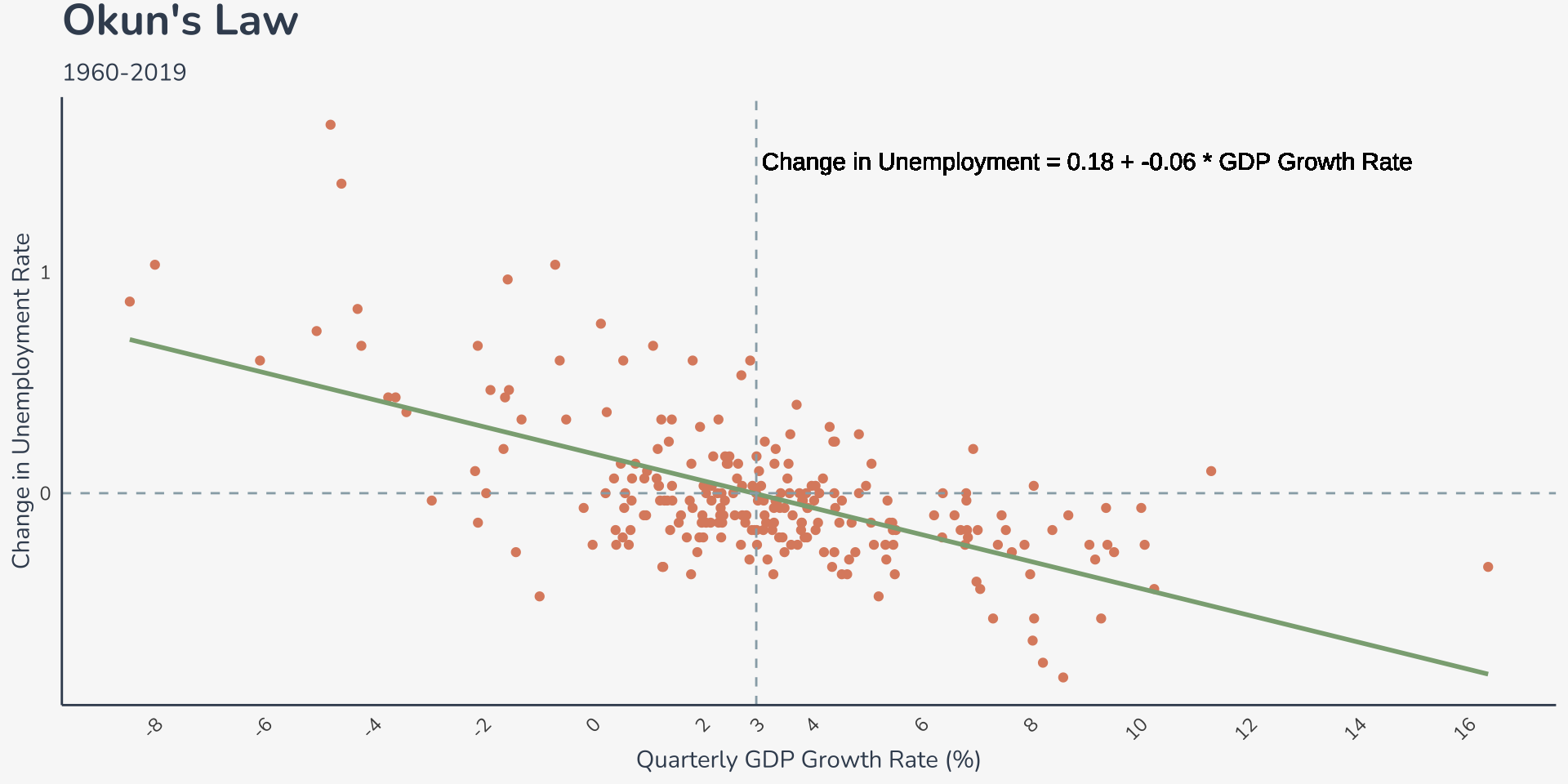

Okun’s Law

Quantifies the empirical relationship between changes in the unemployment rate and real GDP growth.

Reflects the inverse relationship between economic growth and unemployment.

Provides a useful rule of thumb

Review and to do

Review

1

Finishing GDP

2

Labor Market Measures

3

Labor Markets Now

4

Review and to Do